Building a business is hard. Some people have incredible networks, experience, access to capital and business models that don’t require them to raise funds. Many others do not.

You may find yourself in a place where you don’t have the ability to fund your own business. You also may not have a great network of wealthy people and investors who are willing to fund your idea at an early stage.

There are talks of the “family, friends and fools” round. This is another luxury. Most of us don’t have wealthy people around us who we are able to ask for money.

So, where does that leave you? Most likely, you may need to reach out to net-new people and see if they are willing to invest in your business. Of course, there are other forms of capital and there are a lot of consequences of bringing in investor money, but this still may be a path you want to or need to go down.

In that case, you will need to identify, message, build relationships, and convince investors who are seeing thousands of companies a year that you are not only interesting but exceptional.

Sound hard? It’s harder than it sounds. Especially, if you are a first-time founder without a prestigious education, experience at a FAANG and a previous exit.

You must take everything that I write here with a grain of salt, because, as I write this, I have been unsuccessful in my attempts to do cold outreach and close an investment round. This is as much of a guide for me as it is for you.

I will say, I have some confidence I am delivering a valuable resource here because I need this in my own life. Additionally, I’ve raised over $250,000 in non-dilutive capital, much of that after going through a due diligence process that is not that different from how an investor would run you through it.

I’ve linked some great resources at the bottom of this.

How do you find investors?

This is an important place to start. Many of us get lost in this initial process. Who do we talk to? We can waste weeks and months talking to the wrong investors who will never fund us.

Depending on what stage you are at, what industry you are in, and where you are located geographically, the appropriate investors change significantly.

Some of the greatest resources I’ve found for identifying investors are:

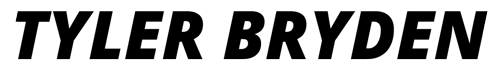

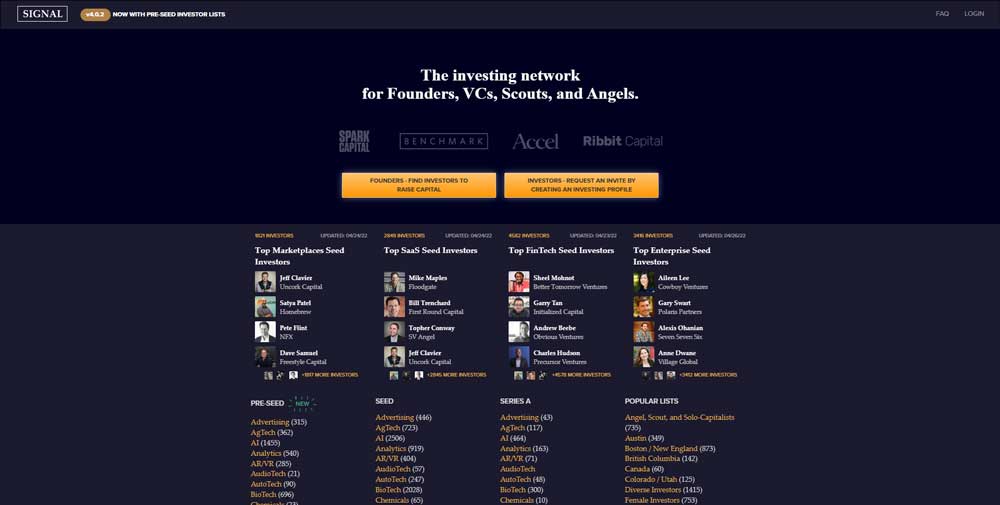

Signal is an incredible resource for identifying investors that fit the category that you are looking for.

In fact, they have entire curated lists for investors. For example, if you want to find pre-seed investors in Digital Health there is literally a curated list with almost all the information you need.

There are even ways to click on individuals and export information out in bulk.

You can pair this with a tool like GetProspect and quickly identify emails and social media information of investors that are worthwhile to reach out to.

If you have the non-premium version of LinkedIn, you can filter by “People” and put keywords like “investor”, “seed investment”, “venture capitalist”, and “angel investor” into your search and then reach out to people.

I recommend starting with people who are 2nd-degree connections where there is a common person between you. You can reach out to them personally through a LinkedIn connection request with a personalized note, use GetProspect to find their email, or ask the connection to introduce you.

Additionally, you can find lists of venture capital firms, visit their company page and then view the people who work for the company.

If you have LinkedIn Sales Navigator, you can filter down even tighter with combinations of job titles, seniority and more. Ideally, you are reaching out to partners at the first instead of junior scouts who have considerably less power in successfully pushing deals through.

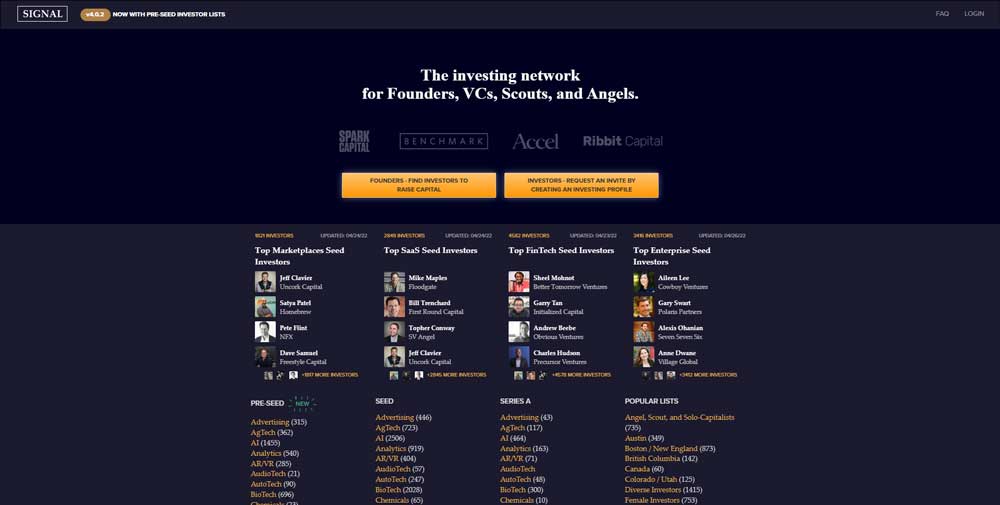

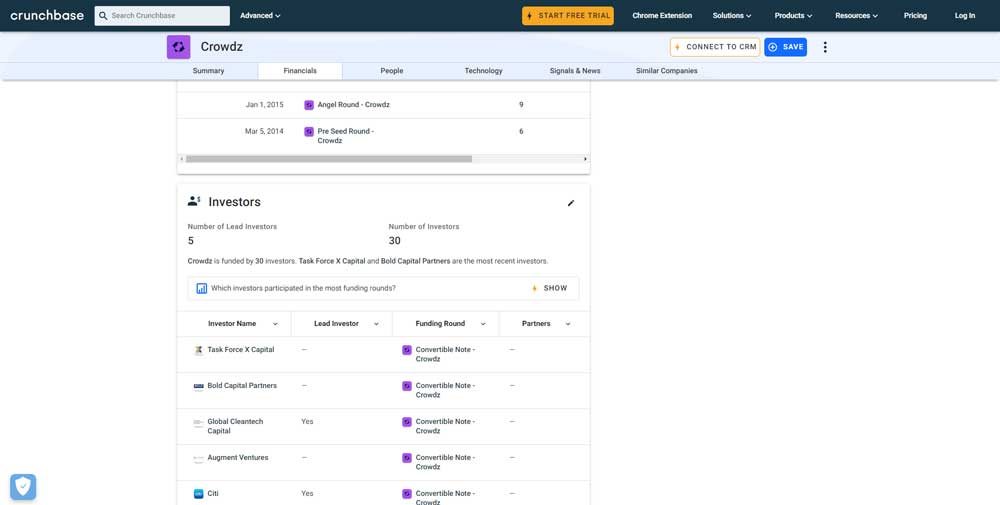

On CrunchBase, you are able to see companies fundraising rounds and who supported them.

You can look at companies at similar stages and industries (although if you are competitors it is likely an investor won’t invest in you) and then identify firms that seem worthwhile to connect with.

Here, again, you can use LinkedIn and GetProspect to your advantage and find multiple contact points. I’ve heard about lots of deals starting in Twitter DMs too!

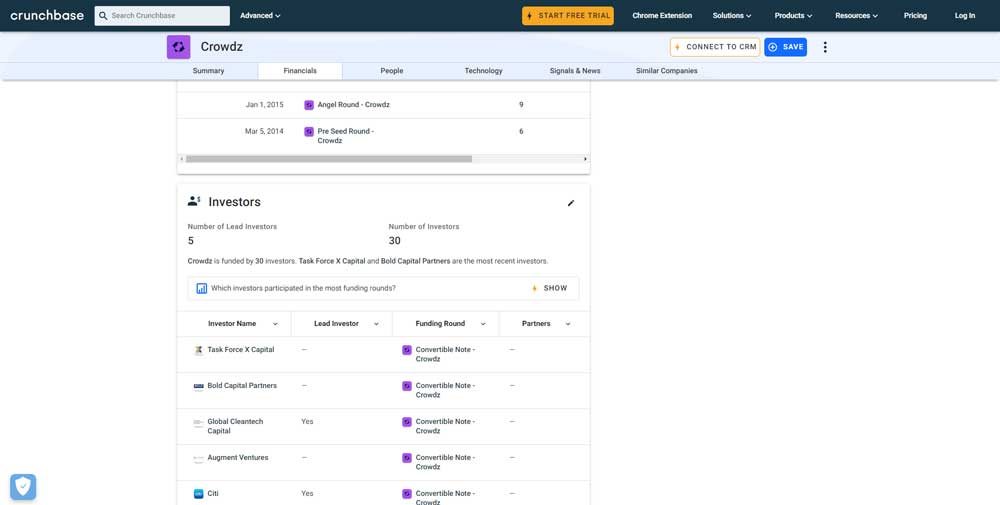

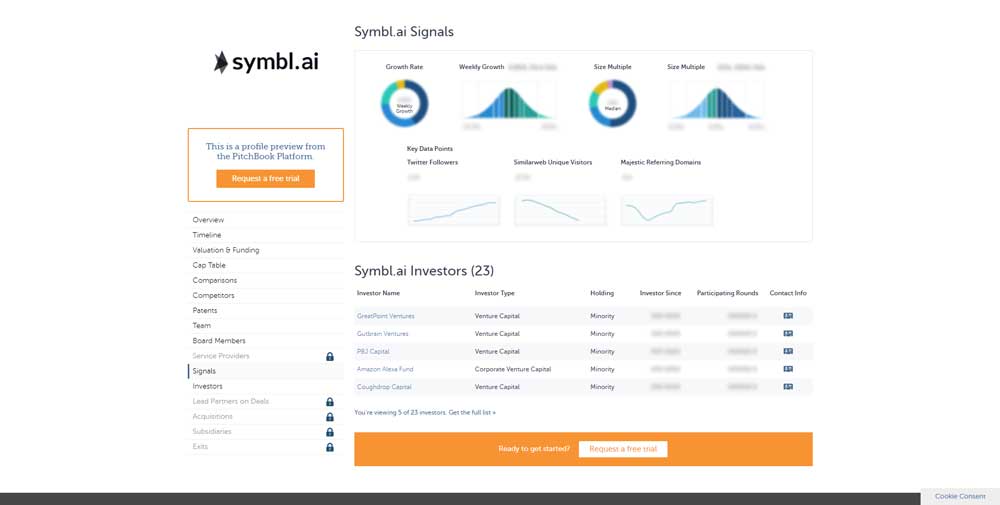

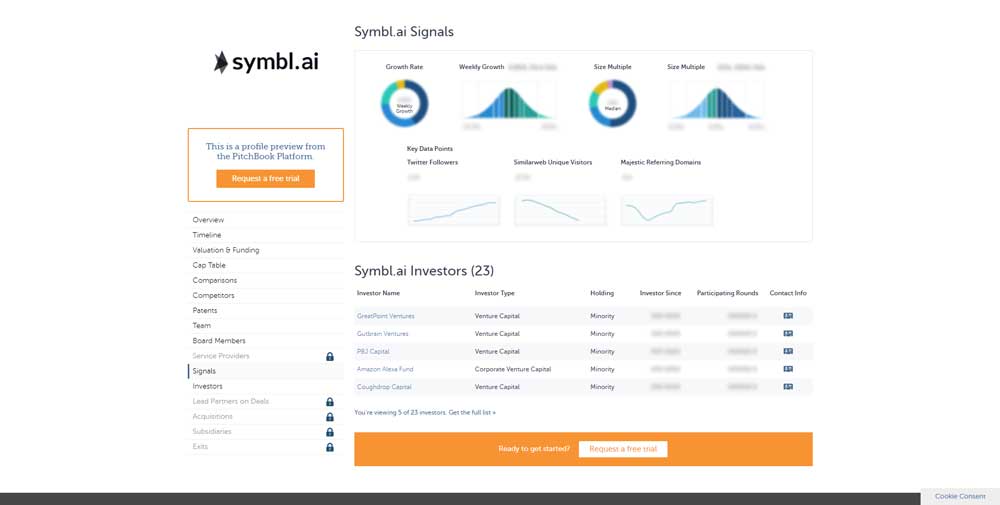

PitchBook

Pitchbook takes investor information a level further with cap tables and other relevant information. Now, you only get to view so much in the free version and I believe the paid plan is expensive as hell but there may be some information gleaned out of it that is valuable for you.

You Will Receive Many “No’s”

Most likely, you won’t get a response at all. Investors get so many emails sent to them. Many are random people reaching out like us. Others are warm intros from founders they support already. Others are from portfolio companies raising additional rounds or needing support. Others are communicating with the people they raised their money from for their fund.

So, when we reach out, it is important to remember these are busy people with valuable limited time. If you want to have a chance to even get a read and a response you need to be concise and compelling.

If you get passed the open and read, most likely you will get several non-descript emails like this:

This sucks a lot. But, you can be thankful they aren’t wasting your time.

Subject Lines

On a cold email, the subject line is the first thing an investor will see. If it is not valuable enough, they will most likely ignore it completely or open it for a quick read with skepticism.

After doing some research, there are a few ways to structure a headline. Here is what we’ve found at least gets our emails opened:

Company Name – Quick Pitch Line – Traction – Investment Round

We’ve found the more you make traction specific the more likely you are to get an open and a response. However, if your traction is weak, this will almost certainly lead to nos.

I’ve talked about it before but generally, the feedback we are getting even with investors who say they are pre-seed and seed is that they want to see $1 million annual recurring revenue (ARR) or $50,000 monthly recurring revenue (MRR).

That is a big milestone for many companies to get to without resources, networks, and capital. Again, this changes with second-time founders, ex-FAANG employees, groundbreaking ideas and innovations or the right timing on trends. But, if you are reading this, most likely you aren’t having that experience.

Emails Contents

If you can get an open you’ve accomplished one part of your journey. The next part gets even harder. How do you put together compelling copy to articulate your company that is easy to comprehend and creates interest? Ideally, you are aiming to push the conversation into a phone call where you get a chance to show who you really are and dive deeper into why you will be successful.

Here are a few things we’ve found work in getting a response (even if that response is a no):

Personalization

If you take a few minutes to personalize the email for the specific investor you are reaching out, your likelihood of success will increase.

I’ve done ridiculous personalization attempts like quoting Seinfeld and sharing my favourite hip-hop artists (these were all relevant and not out of nowhere). More traditionally, I’ve shared some companies I love in their portfolio, an insight I gained from their mission, manifesto or philosophy (they all seem to have one of these) and something that resonates with me personally (often found in their bio or in LinkedIn or other social media activity).

Even if you don’t get a response, if you’ve spent a few minutes personalizing the email, at least they may feel you aren’t just spamming everyone in Silicon Valley for your round.

Company Description

You have to remember that most likely these people have no idea who you are. So, a short concise description of who you are, what problem you are solving, and the value proposition is important.

Right now, ours is:

“Our SaaS platform helps growing teams like Ipsos, IEEE and Salesforce transform untapped language data into actionable insights at scale – fast and with no code.”

Traction

We share a few traction points that are valuable for investors to know and show that you have validation, revenue and growth. If you have any data points that can be compared and show growth that is recommended.

Our current breakdown is:

Sign-ups

Active paying customers

Software MRR

Software ARR (with YoY growth)

Media Files Analyzed (with YoY growth)

The Opportunity

In this part of the email (which we’re trying to decide if we should include) we share the amount we are trying to raise, the structure of the round (for example, a SAFE or convertible note), the discount and the post-money valuation.

This provides investors clarity on you, your goals and the valuation of your company and helps them decide if they want to explore further with you.

Use of Funds

In a few bullet points, we share how we will deploy the capital and what milestones will be accomplished with that capital.

Call-to-Action

Lastly, we end with:

“We are excited to continue our growth trajectory and would love to explore if there is a path to value creation together.

Here is an up-to-date slide deck and a video presentation with a quick product demo if you want to learn more.

If you’re interested, happy to jump on a quick call. Just share your availability or use my Calendly link to find a convenient time.”

Here, you can see we provide a few resources for them to gauge if they want to jump on a call. We also make scheduling those calls quite simple.

Updated Notes

I am trying to shorten my email and have removed “The Opportunity” and “Use of Funds” temporarily.

I don’t think we have the metrics to really wow investors, the well-known all-star team, and we are in a market a lot of investors think is over-saturated and too competitive. That means we need to be more compelling in some way.

It will be helpful to show month-over-month growth because maybe the top-line revenue metric isn’t impressive enough but the growth rate indicates a strong trajectory.

Resources

The Art of a Cold Email to a Venture Capitalist – Crunchbase

How I Turned A Cold Email Into A $2.5M Seed Round | by Allie Janoch | Medium

2 Cold Emails I Funded For Millions

Writing a Cold Email Template for Venture Capital Investors –

How to Write Cold Emails to Investors – Lessons from 30 VCs

Best templates for a cold fundraising outreach campaign